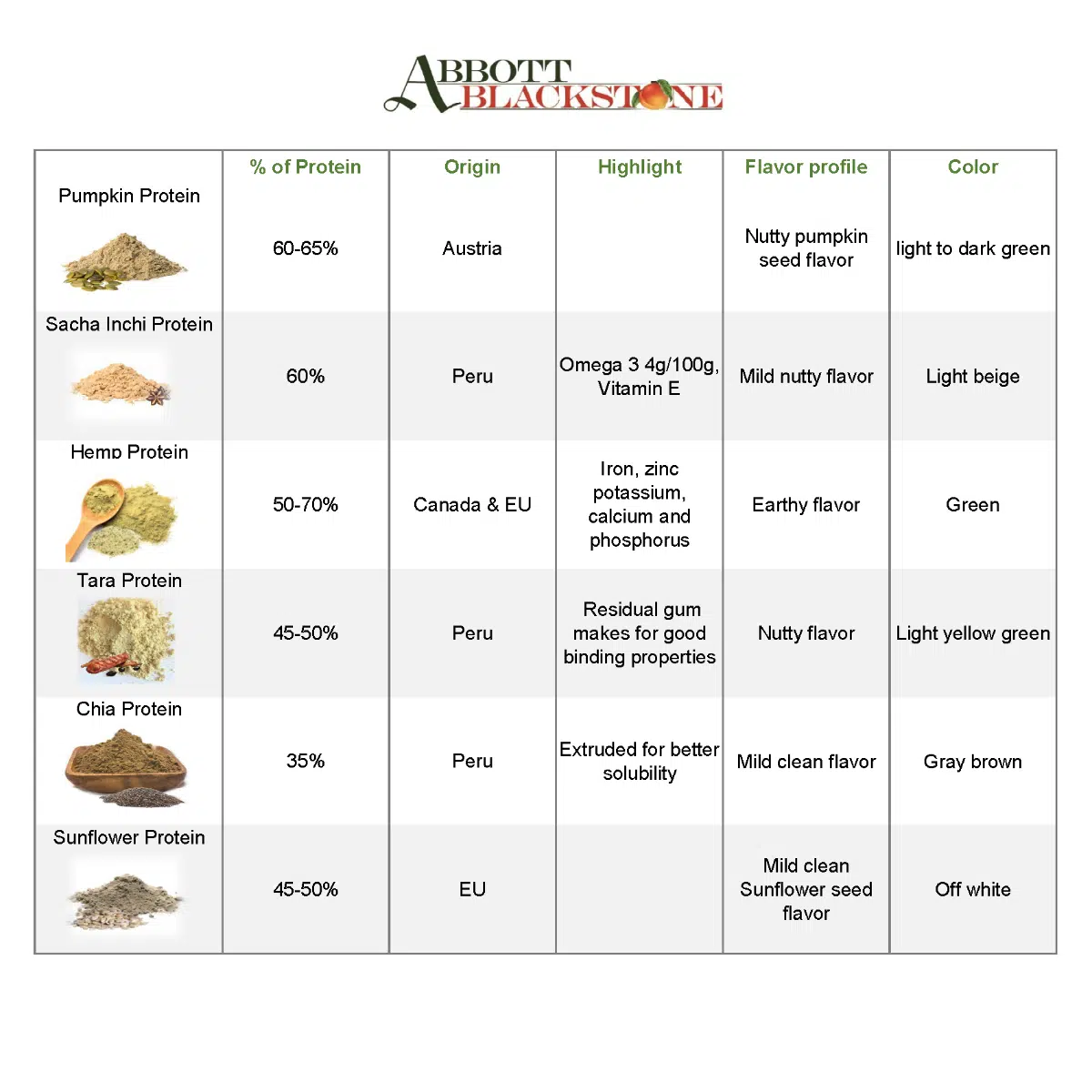

A food industry market research report published on February 9th 2021, projected that the global plant based protein market size would increase from $10.3 billion in 2020 to $15.6 billion in 2026 – in other words 50% growth over the next 5 years. So In this month’s newsletter we wanted to highlight our line of specialty plant based proteins. While we do offer the more widely used protein formats of pea, rice, etc., we have seen increased interest and shift to cleaner and less intensively processed plant protein formats. We have done a lot of work to build out this enhanced plant protein offering outlined below. Please let us know if you have any questions or would like to see samples.

Over the course of mid to late Q1 2021 we have seen Maca prices increase by 35%, and many exporters we’ve spoken to in Peru, forecast that these prices may rise further still. In essence two forces are at play.

The first is the long term price normalization from the 2014/2015 Chinese demand driven price spike to 10-15X historical prices and the subsequent demand collapse from China (they started largely growing their own as well) which resulted in a vastly oversupplied market and subsequent price collapse to 1/3rd historical prices in 2016 and 2017.

These low prices spurred western demand and rising aggregate demand in the ensuing years helped clear out the excess supply and prices started to rise steadily over the last 2-3 years. With this recent 35% jump in prices, Maca is more or less priced at historically normalized prices (not inflation adjusted). In other words current prices are about where Maca was priced before the Chinese-led mania drove prices up by 10-15X in 2014 & 2015.

The second of the two factors is more specific to the current season we are in as well as Covid related increase in consumer demand for health boosting adaptogens like Maca. The fact is Maca is one of the cheapest adaptogens on the market and widely recognized for its health boosting properties. The 2020 crop (late June through early August) was smaller than expected due to frost damage but more than that, overall demand is just higher with increased consumer focus on health. This late in the season what little raw material that remains is going for a premium and from what we’ve heard from exporters in Peru, many do not want to accept any large orders for Maca now, given that prices are so volatile and large raw material inquiries to farmers would likely cause prices to rise further. We still have another 2.5 months to go before harvest starts and another 4.5 months or so before one can reasonably expect new crop to start shipping from origin Callao port in Peru.

Given the multi-year price trend described above I would not be surprised to see much price relief from new crop. We generally expect prices to maintain current levels, for the most part, or perhaps rise even more. The recent run up in prices aside, we think the bigger issue in the coming months will simply be local (EU & US) availability, given international freight delays and low remaining raw material stocks relative to demand. Please reach out to ensure your requirement are covered through October 2021 to prevent delays and stock outs.

Contact our sales team to assist you with anything you need!

info@abbottblackstone.com

Phone: +1 727 461 5626